"Crisis" Management

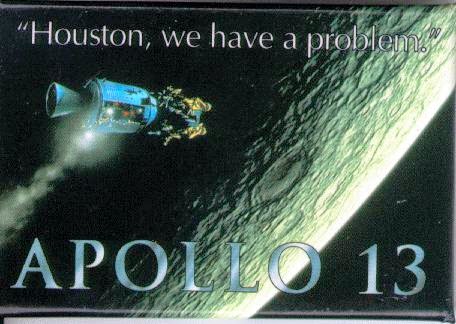

“Houston, we have a problem.” That’s perhaps the most famous quote from one of my favorite movies—the 1995 “Apollo 13,” the story of the ill-fated moon landing mission of the same name. As the third such undertaking, it was a mission that the nation largely ignored—until that mission ran into trouble. Trouble in this case meant having an oxygen tank explode two days into their trip to the moon, which led to a reduction in power, loss of heat in the cabin, a shortage of drinkable water, and ultimately the need to jury-rig the system that removed carbon dioxide from the cabin. Arguably, Apollo 13 didn’t have a “problem”; they had a crisis, and one that threatened their very lives. While we’re a few years removed from the financial crisis that led to the so-called Great Recession, “crisis” is a word much bandied about these days. Crisis is, after all, one of those descriptors that cry out for swift and decisive action—and the industry of employee benefits has its fair share. Thus,...