Connecting the Dots

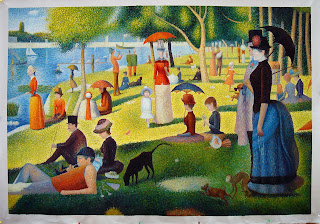

One of my favorite works of art is “A Sunday Afternoon on the Island of La Grande Jatte,” by Georges-Pierre Seurat. I was introduced to this painting in college via an art appreciation class at the Art Institute in Chicago (it even makes a brief appearance in the film “Ferris Bueller’s Day Off”).

The subject matter isn’t really extraordinary―just a group of individuals scattered about a park taking in the scenery. But what amazed me the first time I got close to the painting―and does to this day―is that Seurat created these images, and the marvelous color shadings in these images, through the use of thousands (perhaps millions: the painting itself measures 7 by 10 ft.) of individual dots.

Individual retirement accounts (IRAs) are a vital component of U.S. retirement savings, representing more than 25 percent of all retirement assets in the nation, with a substantial portion of these IRA assets originating in employment-based retirement plans, including defined benefit (pension) and 401(k) plans. Little wonder that those accounts have been a focus of the pending fiduciary regulation re-proposal.

Despite IRAs’ importance in the U.S. retirement system, there is a limited amount of knowledge about the behavior of individuals who own IRAs, alone or in combination with employment-based defined contribution (DC) plans.

Consequently, the Employee Benefit Research Institute (EBRI) created the EBRI IRA Database, which for 2011 contained information on 20.5 million accounts with total assets of $1.456 trillion. When looking across the entire EBRI IRA Database, as of year-end 2011, 44.4 percent of the assets were in equities, 10.7 percent in balanced funds, 18.0 percent in bonds, 13.0 percent in money, and 13.8 percent in other assets―an allocation spread roughly comparable to that found for 401(ks) in the EBRI/ICI 401(k) database at a comparable point in time.

But when you look inside the IRA database, certain interesting aspects emerge. For example, the asset allocation differences between genders were minimal: bond, equity, and money allocations were virtually identical. Moreover, in looking across IRA types, the average equity allocation at each age group was higher for owners of Roth IRAs than for owners of other IRA types―this is perhaps not surprising when you consider that a separate EBRI analysis also revealed that individuals contributing to Roth IRAs tended to be younger. Additionally, as the most recent report reveals, balanced funds have by far the largest asset allocations among young (under age 45) Roth IRA owners.

One might not be surprised to discover that both genders’ average allocations to bonds increased with age (starting at age 25), although the average amount allocated to balanced funds decreased as the age of both genders increased after age 25―with the exception of men ages 75–84. And while equity allocations for genders peaked and then plateaued for those ages 45−54, it then proceeded to INCREASE for male owners age 85 or older.

Of course, an IRA could be only part of an individual’s portfolio of retirement assets: That’s why the goal of the integration of the EBRI databases is to be able to look at the two largest sources of retirement assets (IRAs and DC plans) to examine owner behavior across (as well as within) the accounts to provide a better understanding of the decisions Americans make with their retirement savings.

Because sometimes you need to see the big picture―and sometimes the better understanding of the big picture comes from connecting the dots.

- Nevin E. Adams, JD

The October EBRI Notes article, “IRA Asset Allocation, 2011” is online here.

Also see “The Generation in Roth IRA Contributions,” online here.

The subject matter isn’t really extraordinary―just a group of individuals scattered about a park taking in the scenery. But what amazed me the first time I got close to the painting―and does to this day―is that Seurat created these images, and the marvelous color shadings in these images, through the use of thousands (perhaps millions: the painting itself measures 7 by 10 ft.) of individual dots.

Individual retirement accounts (IRAs) are a vital component of U.S. retirement savings, representing more than 25 percent of all retirement assets in the nation, with a substantial portion of these IRA assets originating in employment-based retirement plans, including defined benefit (pension) and 401(k) plans. Little wonder that those accounts have been a focus of the pending fiduciary regulation re-proposal.

Despite IRAs’ importance in the U.S. retirement system, there is a limited amount of knowledge about the behavior of individuals who own IRAs, alone or in combination with employment-based defined contribution (DC) plans.

Consequently, the Employee Benefit Research Institute (EBRI) created the EBRI IRA Database, which for 2011 contained information on 20.5 million accounts with total assets of $1.456 trillion. When looking across the entire EBRI IRA Database, as of year-end 2011, 44.4 percent of the assets were in equities, 10.7 percent in balanced funds, 18.0 percent in bonds, 13.0 percent in money, and 13.8 percent in other assets―an allocation spread roughly comparable to that found for 401(ks) in the EBRI/ICI 401(k) database at a comparable point in time.

But when you look inside the IRA database, certain interesting aspects emerge. For example, the asset allocation differences between genders were minimal: bond, equity, and money allocations were virtually identical. Moreover, in looking across IRA types, the average equity allocation at each age group was higher for owners of Roth IRAs than for owners of other IRA types―this is perhaps not surprising when you consider that a separate EBRI analysis also revealed that individuals contributing to Roth IRAs tended to be younger. Additionally, as the most recent report reveals, balanced funds have by far the largest asset allocations among young (under age 45) Roth IRA owners.

One might not be surprised to discover that both genders’ average allocations to bonds increased with age (starting at age 25), although the average amount allocated to balanced funds decreased as the age of both genders increased after age 25―with the exception of men ages 75–84. And while equity allocations for genders peaked and then plateaued for those ages 45−54, it then proceeded to INCREASE for male owners age 85 or older.

Of course, an IRA could be only part of an individual’s portfolio of retirement assets: That’s why the goal of the integration of the EBRI databases is to be able to look at the two largest sources of retirement assets (IRAs and DC plans) to examine owner behavior across (as well as within) the accounts to provide a better understanding of the decisions Americans make with their retirement savings.

Because sometimes you need to see the big picture―and sometimes the better understanding of the big picture comes from connecting the dots.

- Nevin E. Adams, JD

The October EBRI Notes article, “IRA Asset Allocation, 2011” is online here.

Also see “The Generation in Roth IRA Contributions,” online here.

Comments

Post a Comment