That Sinking Feeling?

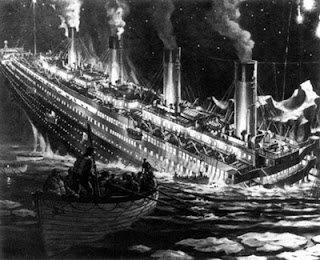

You may have missed it – but we just passed the anniversary of the 1912 sinking of the now iconic RMS Titanic, at the time the world’s largest ocean liner.

Its passengers included some of the wealthiest people in the world, as well as a large number of emigrants seeking a new life in North America. On the ocean liner’s maiden – and only – voyage, it carried 2,244 people, 1,514 of whom would perish in the North Atlantic.

In hindsight, the Titanic seems a textbook example of a

disaster that could have been avoided: There were plenty of warnings

about sea ice (as many as six), but the ship was traveling near her

maximum speed (though it’s a movie myth that they were trying to set a

speed record) when lookouts sighted the iceberg that did her in with a

“glancing” blow – that nonetheless opened 6 of her 16 compartments to

the sea (the ship was designed to stay afloat with four of her forward

compartments flooded). And let’s not forget that she went to sea with a

lifeboat rescue system designed to ferry passengers to relief vessels

and return for more, not to hold the entire ship’s company while help

arrived.

In hindsight, the Titanic seems a textbook example of a

disaster that could have been avoided: There were plenty of warnings

about sea ice (as many as six), but the ship was traveling near her

maximum speed (though it’s a movie myth that they were trying to set a

speed record) when lookouts sighted the iceberg that did her in with a

“glancing” blow – that nonetheless opened 6 of her 16 compartments to

the sea (the ship was designed to stay afloat with four of her forward

compartments flooded). And let’s not forget that she went to sea with a

lifeboat rescue system designed to ferry passengers to relief vessels

and return for more, not to hold the entire ship’s company while help

arrived.

‘Flat’ Lines

I’ve not yet seen anyone link the nation’s retirement prospects to the Titanic, though the headlines routinely portray its condition in similar tones. Even today, it’s hard to believe that, despite the enormous expenditure of time and treasure, the retirement plan coverage “gap” – the number of workers with access to a retirement plan at work – has basically been flat… for the past 40 years.

Now, we all know that most of that coverage gap is self-inflicted. Nothing stops those uncovered individuals from stopping by their local financial services institution to open a retirement savings account – or taking the time to go online or boot up an app to do the same without leaving the comfort of their home. But we also know the realities of human behavior. And yet, despite all the alarmist headlines about retirement gaps and shortfalls, where’s the sense of urgency (see below)?

We know that even modest income workers are 12 times more likely to save for retirement if they have access to a plan at work than they are to take the time to open that IRA. Little wonder that in recent years the Retirement Confidence Survey (RCS) published by the Employee Benefit Research Institute (EBRI) and Greenwald Associates has noted a strong relationship between retirement confidence and retirement plan participation. How strong? Well, workers reporting they or their spouse have money in a DC plan or IRA or have benefits in a DB plan from a current or previous employer are more than twice as likely as those without any of these plans to be at least somewhat confident – we’re talking 75% with a plan vs. 34% without.

It’s not that those who have an opportunity to save for retirement don’t have challenges – in making the sacrifices that allow them to save (while others don’t), in dealing with the inevitable emergency draws on finances (that elusive $400 that surveys routinely say individuals can’t amass in a crisis), or in trying to withdraw funds in a manner that will sustain them throughout retirement.

But having access to a retirement plan at work matters – and not just in confidence.

History tells us that the passengers on the Titanic had plenty of time to get to safety – but they ran short of lifeboats (more tragically, some of the lifeboats they did have weren’t fully utilized!).

Here’s hoping that an increased awareness of the impact of employer-sponsored plans encourages more to build these retirement “lifeboats” – and that those workers who are given the opportunity afforded by these programs, aided by tools like automatic enrollment, contribution escalation, and qualified default investment alternatives – take full advantage.

While there’s still time to do so.

- Nevin E. Adams, JD

Author’s Note: Several years ago, there was an NPR report titled, “Why Didn’t Passengers Panic on the Titanic?” in which David Savage, an economist and Queensland University in Australia, compared the behavior of the passengers on the Titanic with those on the Lusitania, another ship that sank at about the same time. Both were luxury liners, and both had a similar number of passengers and a similar number of survivors. The biggest difference in the reactions in these two similar circumstances, Savage concludes in the report, was time: The Lusitania, struck by a U-Boat torpedo, sank in less than 20 minutes, while the Titanic took approximately two and a half hours. Time enough, in the case of Titanic, according to Savage, for social order to prevail over “instinct.”

Its passengers included some of the wealthiest people in the world, as well as a large number of emigrants seeking a new life in North America. On the ocean liner’s maiden – and only – voyage, it carried 2,244 people, 1,514 of whom would perish in the North Atlantic.

In hindsight, the Titanic seems a textbook example of a

disaster that could have been avoided: There were plenty of warnings

about sea ice (as many as six), but the ship was traveling near her

maximum speed (though it’s a movie myth that they were trying to set a

speed record) when lookouts sighted the iceberg that did her in with a

“glancing” blow – that nonetheless opened 6 of her 16 compartments to

the sea (the ship was designed to stay afloat with four of her forward

compartments flooded). And let’s not forget that she went to sea with a

lifeboat rescue system designed to ferry passengers to relief vessels

and return for more, not to hold the entire ship’s company while help

arrived.

In hindsight, the Titanic seems a textbook example of a

disaster that could have been avoided: There were plenty of warnings

about sea ice (as many as six), but the ship was traveling near her

maximum speed (though it’s a movie myth that they were trying to set a

speed record) when lookouts sighted the iceberg that did her in with a

“glancing” blow – that nonetheless opened 6 of her 16 compartments to

the sea (the ship was designed to stay afloat with four of her forward

compartments flooded). And let’s not forget that she went to sea with a

lifeboat rescue system designed to ferry passengers to relief vessels

and return for more, not to hold the entire ship’s company while help

arrived.‘Flat’ Lines

I’ve not yet seen anyone link the nation’s retirement prospects to the Titanic, though the headlines routinely portray its condition in similar tones. Even today, it’s hard to believe that, despite the enormous expenditure of time and treasure, the retirement plan coverage “gap” – the number of workers with access to a retirement plan at work – has basically been flat… for the past 40 years.

Now, we all know that most of that coverage gap is self-inflicted. Nothing stops those uncovered individuals from stopping by their local financial services institution to open a retirement savings account – or taking the time to go online or boot up an app to do the same without leaving the comfort of their home. But we also know the realities of human behavior. And yet, despite all the alarmist headlines about retirement gaps and shortfalls, where’s the sense of urgency (see below)?

We know that even modest income workers are 12 times more likely to save for retirement if they have access to a plan at work than they are to take the time to open that IRA. Little wonder that in recent years the Retirement Confidence Survey (RCS) published by the Employee Benefit Research Institute (EBRI) and Greenwald Associates has noted a strong relationship between retirement confidence and retirement plan participation. How strong? Well, workers reporting they or their spouse have money in a DC plan or IRA or have benefits in a DB plan from a current or previous employer are more than twice as likely as those without any of these plans to be at least somewhat confident – we’re talking 75% with a plan vs. 34% without.

It’s not that those who have an opportunity to save for retirement don’t have challenges – in making the sacrifices that allow them to save (while others don’t), in dealing with the inevitable emergency draws on finances (that elusive $400 that surveys routinely say individuals can’t amass in a crisis), or in trying to withdraw funds in a manner that will sustain them throughout retirement.

But having access to a retirement plan at work matters – and not just in confidence.

History tells us that the passengers on the Titanic had plenty of time to get to safety – but they ran short of lifeboats (more tragically, some of the lifeboats they did have weren’t fully utilized!).

Here’s hoping that an increased awareness of the impact of employer-sponsored plans encourages more to build these retirement “lifeboats” – and that those workers who are given the opportunity afforded by these programs, aided by tools like automatic enrollment, contribution escalation, and qualified default investment alternatives – take full advantage.

While there’s still time to do so.

- Nevin E. Adams, JD

Author’s Note: Several years ago, there was an NPR report titled, “Why Didn’t Passengers Panic on the Titanic?” in which David Savage, an economist and Queensland University in Australia, compared the behavior of the passengers on the Titanic with those on the Lusitania, another ship that sank at about the same time. Both were luxury liners, and both had a similar number of passengers and a similar number of survivors. The biggest difference in the reactions in these two similar circumstances, Savage concludes in the report, was time: The Lusitania, struck by a U-Boat torpedo, sank in less than 20 minutes, while the Titanic took approximately two and a half hours. Time enough, in the case of Titanic, according to Savage, for social order to prevail over “instinct.”

Comments

Post a Comment